georgia property tax relief for seniors

Cobb Cherokee and Forsyth Counties are among those providing an exemption from the school tax. Office of Communications 404-651-7774.

Property Tax Homestead Exemptions Itep

New Yorks senior exemption is also pretty generous.

. Tax Benefits in Georgia. Any Georgia resident can be granted a 2000 exemption from county and school taxes. 2 days agoHenrico Countys manager and finance director are working on a plan to provide tax relief following a hike in personal property taxes.

About the Company Naugatuck Ct Property Tax Relief For Seniors. Our staff has a proven record. Governor Signs Senior Income Tax Cut Eliminates State Portion of Property Tax.

This does not apply to or affect county municipal or school district taxes. It was established in 2000 and has been an. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Wednesday May 12 2010. People who are 65 or older can get a 4000 exemption from county taxes in cases when the individual and their spouse dont have an income larger. Dont Miss Your Chance.

Increases to 20K at 70 and 30K at. The credit amount is the lesser of 1 50 of the taxes due after applying other eligible tax exemptions and 2 500 Del. County Property Tax Facts.

Property Tax Returns and Payment. Georgias seniors get property tax breaks in many counties and a special state tax exclusion that was among the factors used by Kiplingers to rank GA 5 as a tax-friendly state for seniors. About the Company Clallam Property Tax Relief For Seniors.

Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence. Taxes are deferred as long as the homeowner owns the property. Individuals 65 Years of Age and Older.

What is the Georgia homestead exemption. The Georgia homestead exemption is available to. Property Taxes in Georgia.

HUD Title I Property Improvement Loan Program 22 Reverse Mortgages 23 4. CuraDebt is a company that provides debt relief from Hollywood Florida. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

The age for qualifying varies from 62 in California Georgia and Oregon to age 70 in Arizona South Dakota and Florida. The home of each Georgia resident that is. Amador Salazar Amadorsalazarsanantoniogov SAN ANTONIO May 5 2022 As the average value of homes in Bexar County has increased by 28 percent from.

Exempt from all taxes at 62 if household income is less than 20K. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

Take Advantage of All Applicable Tax Breaks Standard Homestead Exemption From Georgia Property Tax. Check If You Qualify For This Homeowner StimuIus Fast Easy. Georgia Senior Homeowners Resource Guide For free answers help call 1-866-55-AGING.

Property Tax Homestead Exemptions. For every hour of volunteer service the homeowner can accumulate credit toward their property tax bill at the federal hourly minimum wage rate which is currently 725 per. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

It was established in 2000 and has since become. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your. At 65 a 10K exemption towards school taxes.

Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and. Homestead exemption is 2K regardless of age. Retirees in Georgia can apply for a property tax exemption or a property tax deferral Hawaii Seniors aged 65 and older in Honolulu can be exempt from paying 120000 of their home value.

Georgia is ranked with other tax-friendly state such as South Carolina Tennessee Alabama and Colorado due to its low-tax climate tax exemptions tax breaks and affordable. Additionally there are a number of exemptions that can help seniors in need of property tax relief. Up to 25 cash back Method 2.

Troopers issue Senior Alert for missing 80.

State By State Guide To Taxes On Retirees Retirement Advice Retirement Best Places To Retire

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Carroll County Board Of Tax Assessors

Paying High Property Tax Get The Ways Of Reducing It Property Tax Tax Consulting Tax Reduction

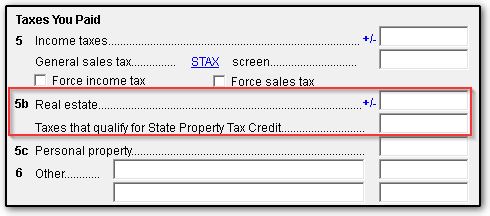

Deducting Property Taxes H R Block

How To Apply For Homestead Exemption In Georgia

Property Tax How To Calculate Local Considerations

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

How To Find A Georgia Employer Identification Number Property Tax Last Will And Testament Tax

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg)

Property Tax Exemptions For Seniors

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

2021 Property Tax Bills Sent Out Cobb County Georgia

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts